Could the BLM’s new oil and gas rule lead to higher energy costs for Nevadans?

Exploring the potential downstream effect from California producers to Nevada consumers

When the Bureau of Land Management (BLM) announced it was modernizing the leasing process for oil and gas drilling on public lands, it initially appeared the ruling didn’t carry significant implications for the state of Nevada. Although over 80% of land in Nevada is federally-owned and managed, there are few oil and gas reservoirs in the state.

However, this ruling, in conjunction with a series of contested state laws in neighboring California, is sparking a broader conversation on how to best transition the energy economy.

“Nevadans probably won’t see much of a direct impact from this BLM decision because oil and gas production in Nevada is already so small,” said Kevin Slagle, vice president of strategic communications at the Western States Petroleum Association. “But across the West and in California, federal lands are still a small percentage of where production occurs.”

According to the BLM, 95% of drilling on BLM-managed lands in California comes from within the San Joaquin Valley, an area known for its high-producing wells and proximity to refineries. However, this seemingly large figure only accounts for 10% of oil and gas production in the Golden State. The majority of California’s oil and gas sources come from state and privately-held lands, which altogether make California the seventh-largest producer of crude oil in the United States.

Meanwhile, Nevadans require substantial amounts of energy. The state consumes six times more energy than it produces, most of which comes from non-renewable sources.

“Nevada is highly dependent upon California and its refineries in the Bay area and the Los Angeles region,” Slagle said. “So we need to be aware of what this rule means nationally, to the extent at which we get our fuels from California or federal lands that might make crude oil a little bit more expensive.”

Before explaining the changes, it’s helpful to understand how it all works.

Oil and gas companies pursue a lease through the BLM when they believe a potential reservoir exists on public lands. But according to the agency, only about half of the roughly 23 million federal acres that were under lease by oil and gas developers at the end of fiscal year (FY) 2022 were actually producing oil and gas in economic quantities.

“These leases don’t necessarily mean production, it just starts an exploration process that can already be economically exhaustive,” Slagle said. “Just because a company pursues a lease doesn’t always mean they actually end up using it, because the exploration may find that the resource is not worth it.”

With the BLM’s updated rule, the leasing process is becoming more expensive. The new rule modernizes the fiscal rates of bonding requirements, royalty rates and rental rates to lease public lands for oil and gas production. The main feature of the rule updates bonding requirements, which aims to eliminate orphan wells by holding oil and gas companies accountable for covering the costs of clean-up and well reclamation after production concludes.

Prior to this rule, bond values set by the BLM required an oil and gas operator to pay $10,000 for wells on an individual unit, $25,000 to cover statewide leases and $150,000 to cover all of an operator’s wells nationwide. But when an operator fails to reclaim the well and return the land to as close to its natural state as possible, that responsibility falls to the BLM. The financial burden is then carried by taxpayers at an average cost of $71,000 per well.

“A $150,000 nationwide bond is not going to cover a lot of cleanup, and that’s the difference the taxpayers have been covering,” said Russell Kuhlman, executive director of the Nevada Wildlife Federation. “This rule lessens the taxpayer burden for clean-up and puts that responsibility back on the companies.”

The new rule eliminates the unit and nationwide bond classifications and increases the minimum bonding rate to $150,000. It also increases the statewide minimum bonding rate to $500,000 and explicitly requires bonding rates be adjusted every decade to account for inflation.

Revisions are also being made to the royalty rates that oil and gas companies pay taxpayers, which until recently was held at a minimum of 12.5%. The new rule brings the royalty rate up to 16.67%, the minimum rate moving forward.

“The 12% royalty rate that companies have been paying the federal government is lower than most states, which are between 16-18%,” Kuhlman said. “So this rule just brings the federal land royalty rate up to what most state and private lands are charging.”

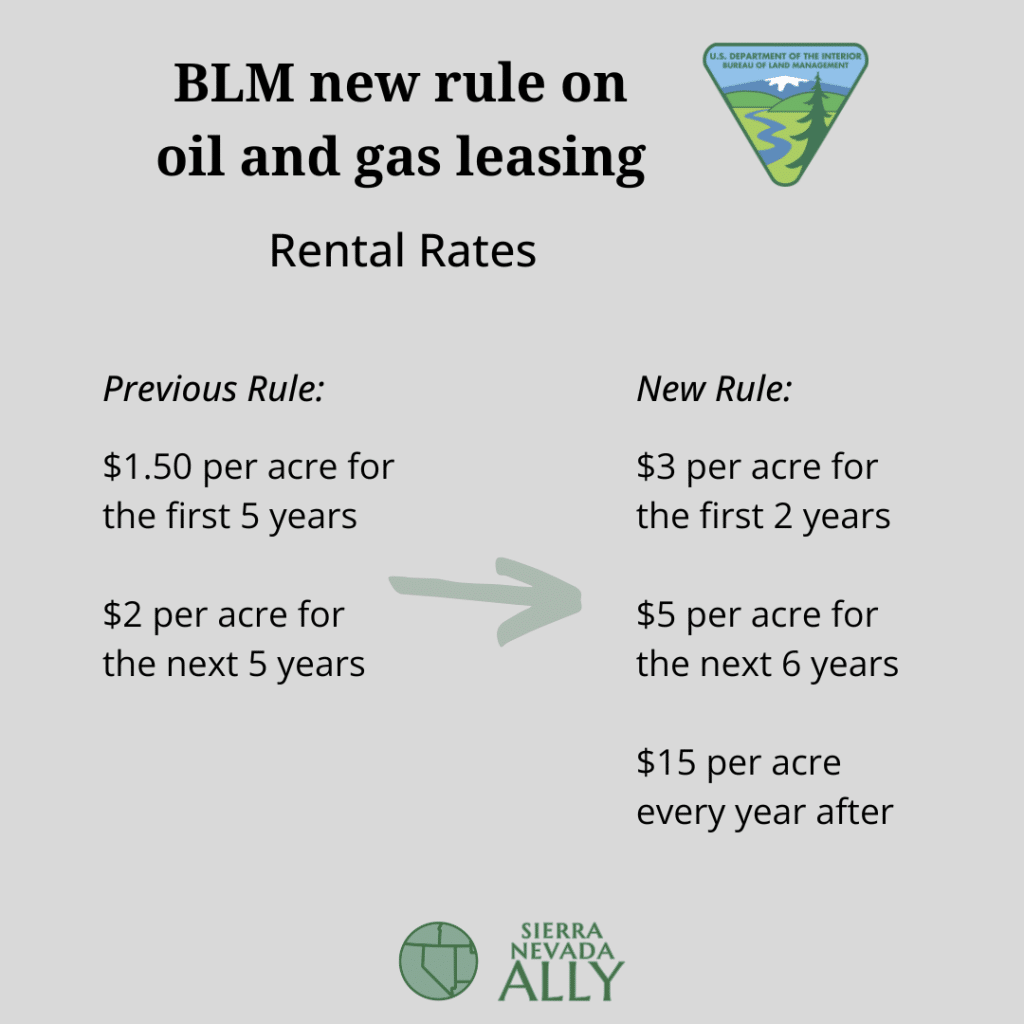

Similar changes are coming to rental rates of public land leases for oil and gas production, which were previously held at $1.50 an acre for the first five years and $2 an acre for the next five years of a lease. The Inflation Reduction Act of 2022 (IRA) actually set the new rental rates, which requires payment of $3 an acre for two years, $5 an acre for the subsequent six years and $15 per acre for every year thereafter. These changes will begin in August 2032, as the IRA stipulates.

While the rental rates are increasing incrementally, Kuhlman says these fiscal changes will help incentivize oil and gas companies to focus their leasing efforts on public lands with higher probabilities of reservoirs.

“This rule means oil and gas companies are going to stop bidding where there’s no potential,” Kuhlman said. “This is going to open up lands for outdoor recreation, mining, solar, lithium and geothermal development. The state of Nevada needs to embrace innovation and job creation in other aspects of public land, because there’s money in saving our landscape.”

Oil and gas production on public lands, however, is still comparatively minimal. According to the BLM, public lands accounted for 11% of all oil and 9% of all natural gas produced in the United States for FY 2022. If this new rule leads to fewer leasing opportunities on public lands, it could mean greater reliance on state and privately-held lands, much like those in California.

“The BLM decision is part of a national trend to pressure our industry to move away from fossil fuels faster. If it’s costlier to get a lease, oil and gas companies will have to rely on other places for exploration. As those markets dry up and there’s a scarcity in supply, that’s when people will become more aware of this rule,” Slagle said. “Oil and gas production in the West won’t be so much constrained by leasing on public lands, as it is by public policy.”

In California, a series of laws have aimed to curtail the use of fossil fuels and accelerate the energy transition.

In 2020, California Governor Gavin Newsom signed an executive order that banned the sale of gas-powered, internal combustion engine vehicles by 2035.

Then in 2022, Senate Bill 1137 effectively banned new oil and gas drilling within 3,200 feet of homes and schools. This measure was quickly challenged by industry advocates and is currently on hold, while a veto referendum is considered in a statewide ballot measure this fall.

Last year, Assembly Bill 631 increased penalties for spills and other hazards to as much as $70,000 per day for continuing violations.

California’s legislative battles continue today. Assembly Bill 1866 would require operators to plug a significant portion of their existing idle wells or be subject to penalties. Lawsuits have also been filed challenging California’s Senate Bill 253 and Senate Bill 261, policies that require large businesses operating in California to publicly report their greenhouse gas emissions and mandate companies disclose the threats they face as a result of climate change, respectively.

That’s why Slagle says that although Nevadans may not see an immediate impact from the new BLM rule, the downstream effects may be felt indirectly over time. That’s because Nevada, which uses natural gas for 56% of its electricity generation, gets about 85% of its total refined petroleum from California.

“If we’re not producing oil and gas in California, then Nevada has to get it from refiners in other states or overseas,” Slagle said. “So while Nevadans will probably not see any immediate impacts from decreasing public land leases now, in five or 10 years, our food, supplies and national logistics may be affected by all of these policies.”

While this supply and demand argument insinuates price hikes for energy producers – and therefore, consumers – not everyone believes that this new rule needs to lead to higher energy costs.

“The argument that this ruling will increase gas prices has no merit,” Kuhlman said. “If oil and gas companies increase gas prices because of this rule, it’s really just because they want an excuse to increase them. Nothing in this rule mandates an increase at the pump. Of course, there’s probably opposition because they have to put more of their profits into where their money comes from.”

The BLM rule and the California measures are coming at a time when the West is actively experiencing the effects of a changing climate and Nevada seeks to capitalize on the budding critical mineral and renewable energy economies.

At the same time, having reliable and secure energy sources are critical for the United States and its Allies during a time of increasing geopolitical instability. Since 2018, the United States has led the world as the largest exporter of oil and gas, with a surge in exports to Europe following Russia’s invasion of Ukraine in 2022.

“As long as there’s a war in Ukraine, the United States is going to have to support Europe and stability in the global oil market,” Slagle said. “These lease issues are important because we can export and support our Allies, but at the very least, we need crude oil to cover our energy needs while we transition to an electric economy.”

That’s why Slagle and other industry advocates say the push for the renewable energy transition should not exclude traditional energy companies that produce fossil fuels – at least until the appropriate infrastructure is in place.

“We have to be realistic that the energy sources we’ve traditionally produced are going to be needed for the foreseeable future,” Slagle said. “It doesn’t mean we shouldn’t have more EVs, or the infrastructure to support them, but we can make a lot of reductions in greenhouse gasses, while at the same time ensuring that we have energy security.”

Republish our stories for free, under a Creative Commons license.